salt tax new york state

1 2021 electing entities are taxed at the following marginal rates. Job DescriptionEisnerAmper is seeking a Manager to join their State and Local Tax practice.

Online Counties Call For Repeal Of Salt Cap

The surcharge rate ranged from 050 to 200 and only applied to taxpayers with income above 5 million.

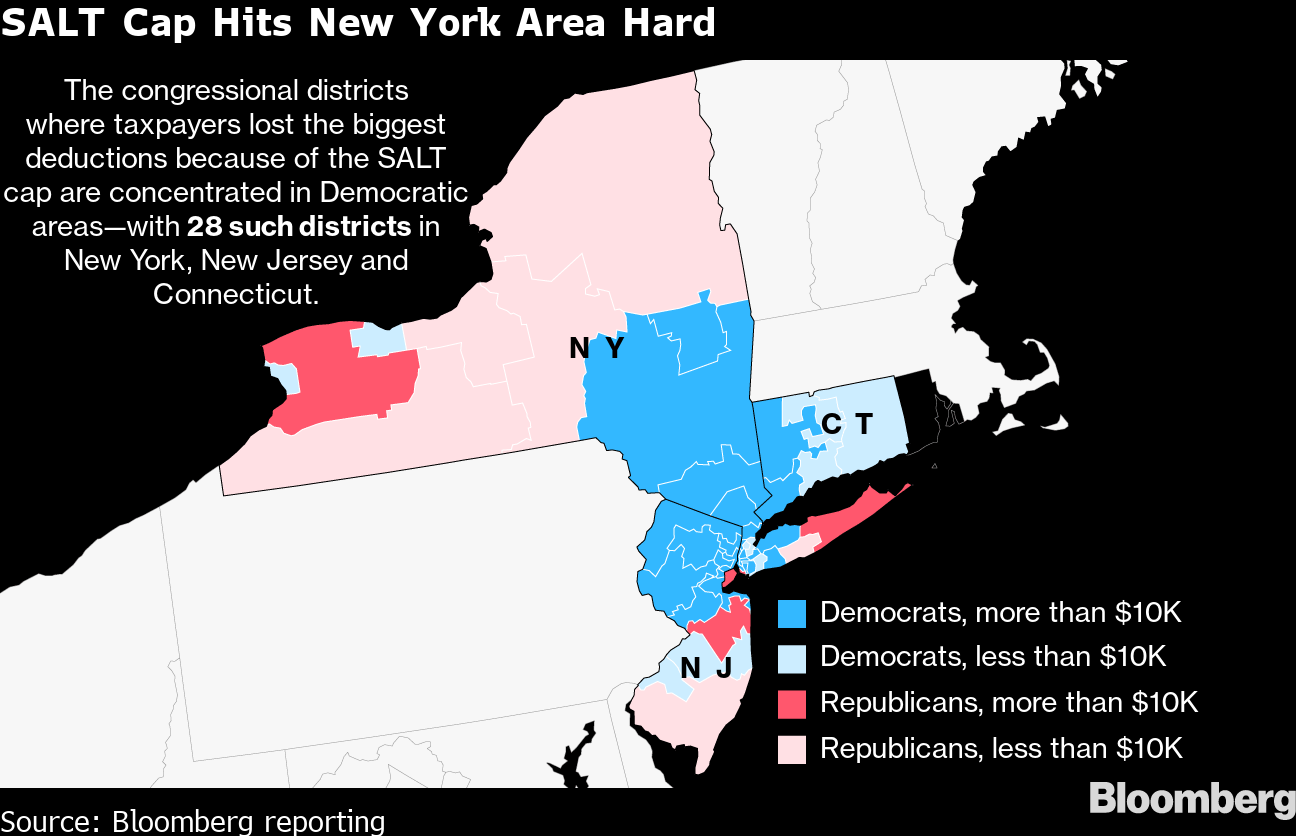

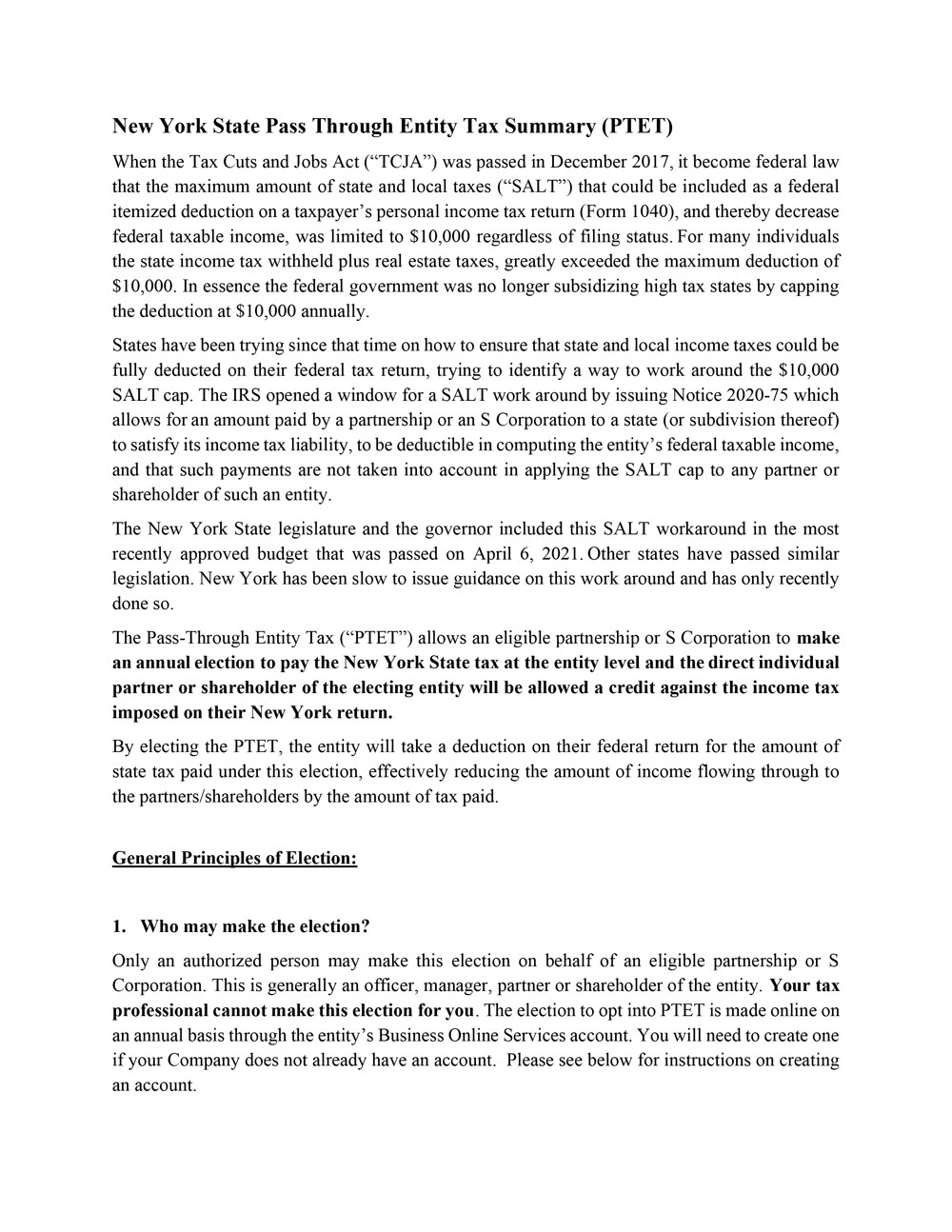

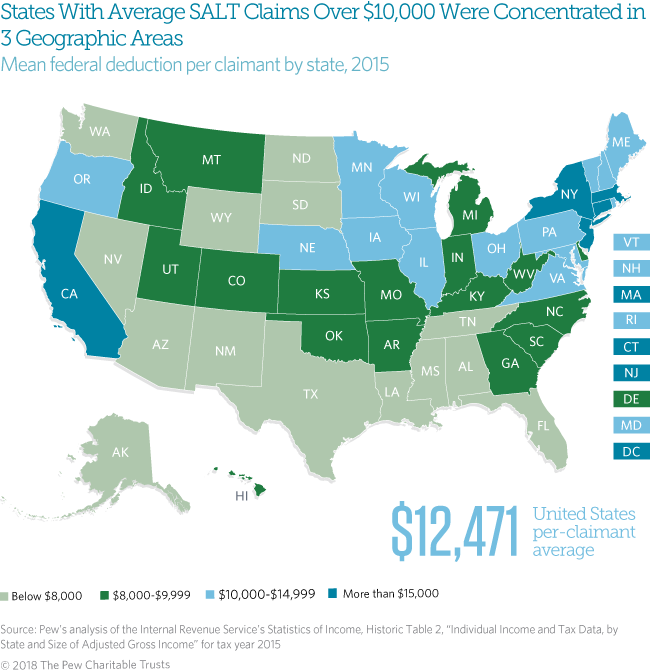

. The Tax Cuts and Jobs Act limited taxpayers itemized deduction for state and local income and property taxes SALT to 10000 per tax year. 16 2020 New York legislation was submitted to impose an unincorporated business tax UBT on partnerships and limited liability companies that are treated as. The SALT cap limits a persons.

Effective for tax years beginning on or after Jan. Despite frustration the so-called SALT Caucus failed to remove the 10000 cap on the state and local tax deductions -- popularly known as SALT -- as part of the recent Inflation. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here.

PUBLISHED 549 PM ET Apr. The New York State Tax Appeals Tribunal affirmed an Administrative Law Judge determination that two taxpayers remained New York residents because the taxpayers did not establish that. The federal Tax Cuts and Jobs Act of 2017.

State And Local Tax Manager jobs 16090 open jobs. EisnerAmper is seeking a Director to join their State and Local Tax practice. Over the weekend New York became the first state to create a state and local tax SALT deduction.

The limitation on the deductibility of state and. 685 for incomes not over 2 million 965 for incomes over 2. New Yorks SALT Avoidance Scheme Could Actually Raise Your Taxes.

We areSee this and similar jobs on LinkedIn. Andrew Cuomos spin on the tax hikes in. Avoiding the SALT Limitation New York Enacts a Pass-Through Entity Tax to Help Taxpayers Work Around the SALT Limitation.

As residents and business. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. In 2017 a 10000 ceiling on the previously unlimited SALT deduction was enacted and made applicable for tax years beginning in 2018 and continuing through 2025.

The Enacted Budget omits the Governors proposed high income. Get email updates for new Tax Manager jobs in New York NY. Friday December 18 2020.

New York is taking another run at repealing SALT cap. The New York Pass-Through Entity Tax can provide significant tax benefits by allowing full deductibility of New York State personal income taxes and avoiding the onerous. Tax Fairness for All Americans.

52 rows The state and local tax deduction commonly called the SALT deduction is a federal deduction that allows you to deduct the amount you pay in taxes to your state or. The first step is to identify the sum of all items of income gain or loss or deduction to the extent they are included in the New York State taxable income of a. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes.

The Tax Cuts and Jobs Act. Under the Trump administration Washington launched an all-out direct attack on New Yorks economic future. We are seeking someone who thrives in a growing environment and providing clients with exceptional services.

Sign in to save SALT Tax Manager. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states. New York has issued long.

By Nick Reisman New York State.

State Salt Cap Challenge Rejected By Second Circuit 1

Salt Cap Increase Ok D By House Now Heads To Senate What May Change

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

New York State Budget Provides A Work Around To The Federal Salt Cap For Certain Business Entities

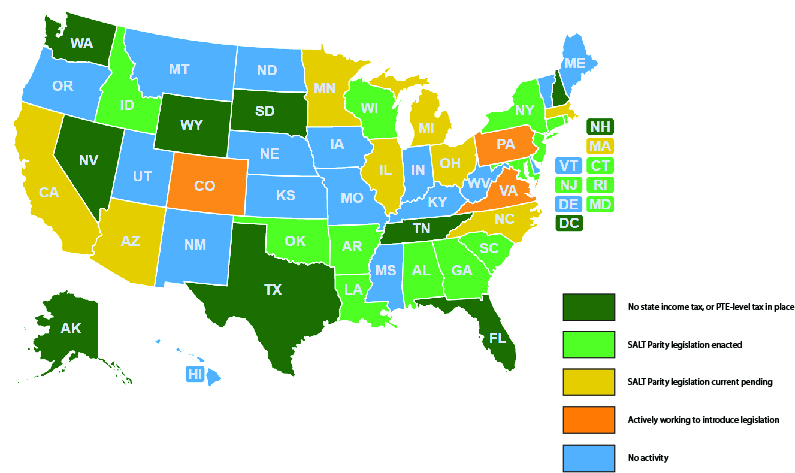

Salt Parity Continues To Roll The S Corporation Association

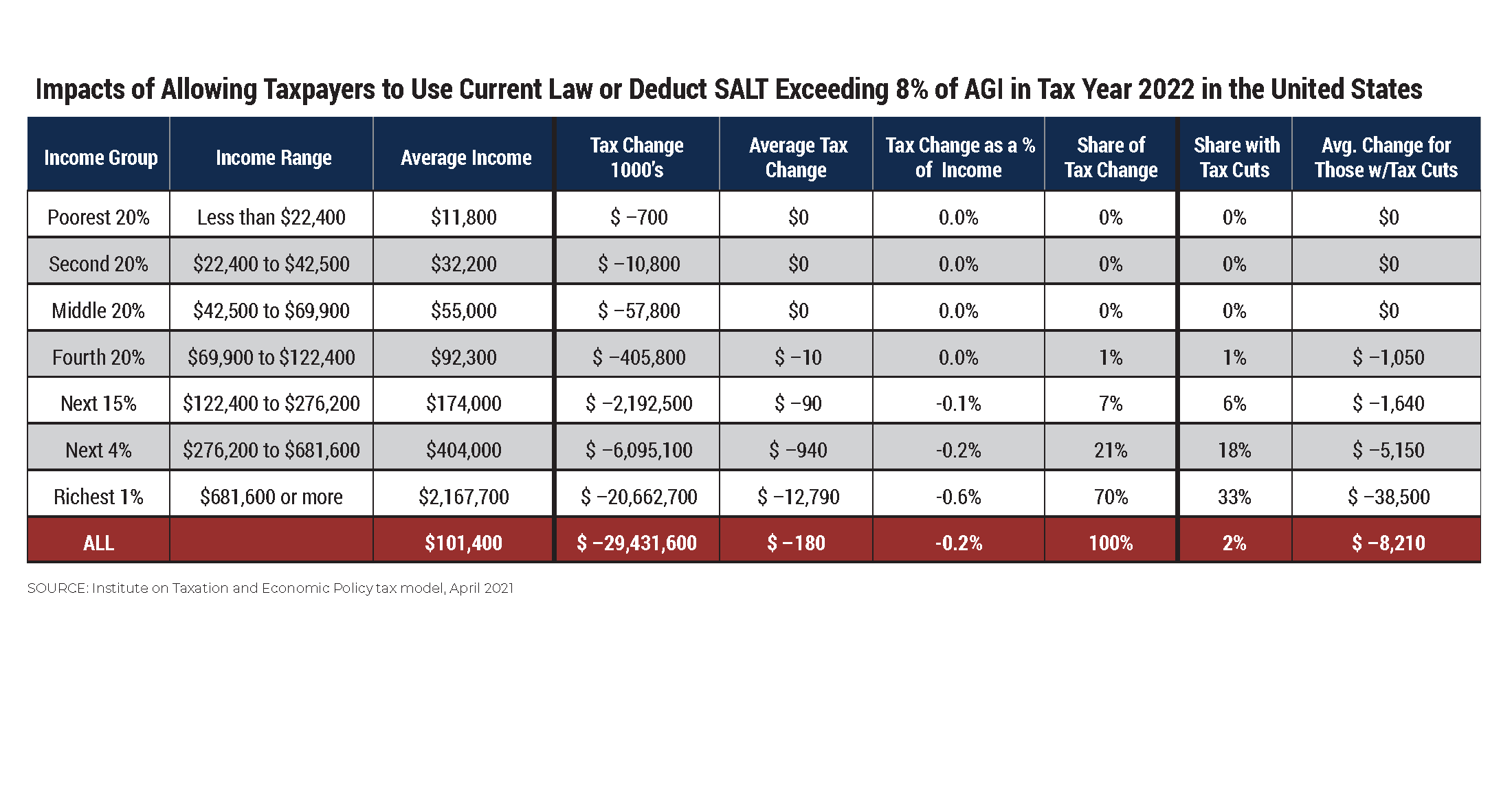

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

New York Expands Credits For Chip Manufacturers Grant Thornton

Dueling Salt Fixes In Play As Democrats Try To Close Budget Deal Roll Call

Irs Challenges State S Effort To Circumvent New Federal Cap On Salt Deductions

Blue States File Appeal In Legal Battle Over Salt Tax Deductions

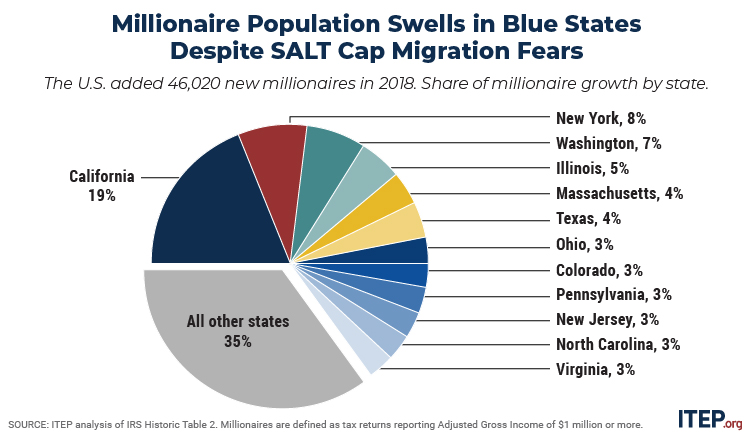

Millionaire Population Swells In Blue States Despite Migration Fearmongering Itep

Salt Cap Revolt Led By N Y Democrats Snarls Biden Spending Plan Bloomberg

Tax Losses From Salt Cap Hit New York State Budget Bond Buyer

Supreme Court Won T Hear Challenge To Salt Tax Deduction The Hill

New York State Pass Through Entity Tax Welker Mojsej Delvecchio

Avoiding The Salt Limitation New York Enacts A Pass Through Entity Tax To Help Taxpayers Work Around The Salt Limitation Wffa Cpas

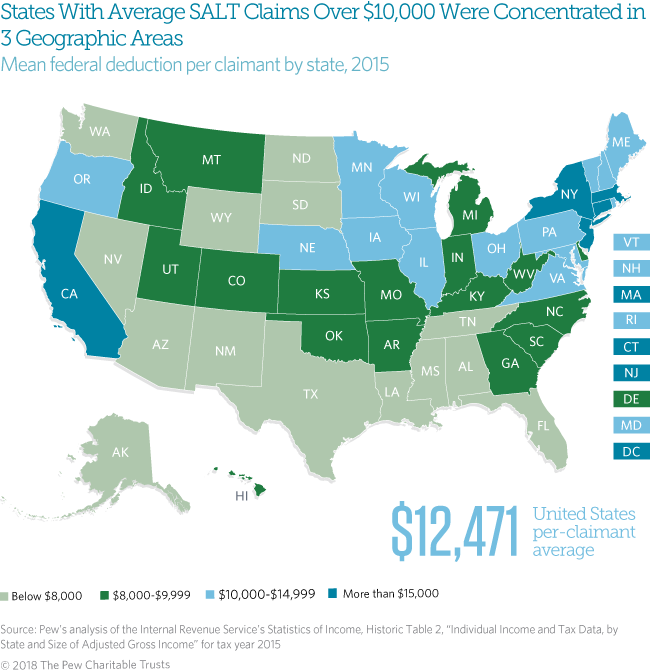

Cap On The State And Local Tax Deduction Likely To Affect States Beyond New York And California The Pew Charitable Trusts